Vietnam Macro Bulletin 1Q2025

May 13, 2025

Q1 Production and consumption activities show positive growth

GDP growth reached 6.93% YoY in 1Q2025, the highest increase in Q1 since 2020 (Chart 1). This positive result mainly stems from growth momentum in the manufacturing and tourism sectors, with key industries such as manufacturing (+9.3% YoY), hospitality and food services (+9.3% YoY), construction (+8% YoY), and transportation and logistics (+9.9% YoY) all achieving good growth rates. This is further confirmed by high export-import growth and record high international visitor numbers.

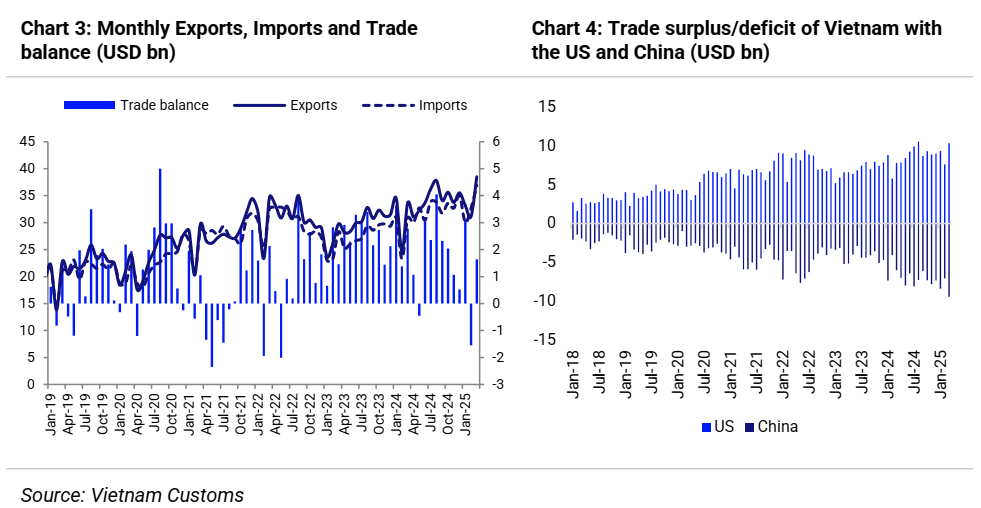

Specifically, exports increased by 14.5% YoY and imports by 19% YoY in March, with a trade surplus of USD 3.15 billion in Q1. Export activities were boosted ahead of the new US tariff policy, clearly reflected in the 32.3% YoY surge in export value to the US in March, and a trade surplus with the US reaching USD 27.3 billion in Q1, up 22% YoY. Conversely, import value from China also saw a strong increase of 24.7% YoY in Q1.

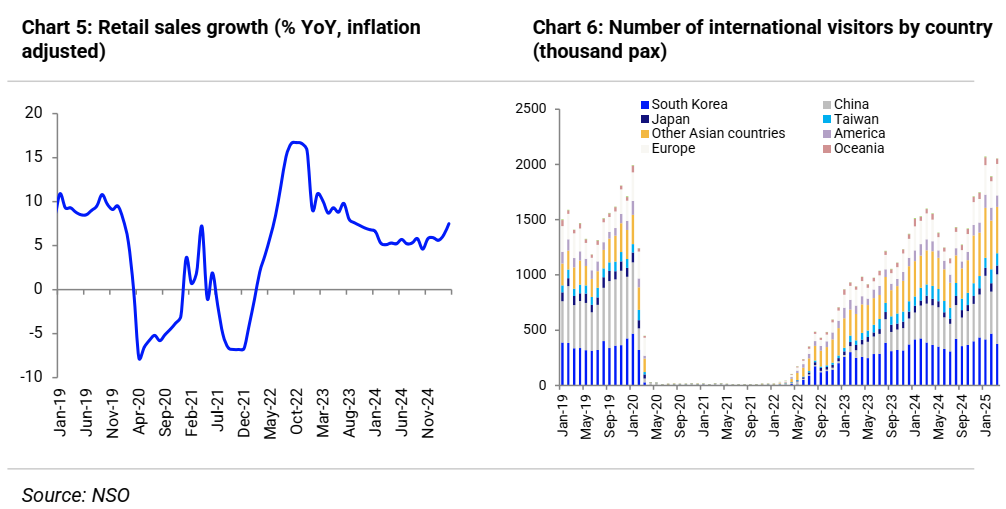

International visitors reached a record high of 6 million in Q1, up 29.6% YoY, driven by a strong recovery in Chinese tourists, with a 78% increase YoY, surpassing South Korea to regain the top position among Vietnam’s tourism markets, accounting for 26.4% of total international visitors to Vietnam in 1Q2025 compared to 19.2% in 1Q2024. Total retail sales increased by 7.5% YoY after excluding inflation, although still lower than the pre-Covid period, this is the highest level in the past 18 months, indicating a significant recovery in retail activities (Chart 5).

On the other hand, the economy still faces bottlenecks in sectors such as real estate, mining, and electricity production and distribution that need to be addressed to promote overall growth. Therefore, to achieve the government’s GDP growth target of 8%, stronger support measures are needed in the last quarters of the year, especially as external challenges are increasing and directly affecting Vietnam’s production and export activities.

Maintaining macroeconomic stability amid rising pressures

Inflation remained well-controlled in Q1, increasing by 3.22% YoY, thanks to stable food and beverage prices (+3.78% YoY) and a decline in fuel prices (-2.4% YoY). Although medicines and healthcare services saw the highest price increase (+14.4% YoY), their impact on the overall index is minimal. Banks continued to lower deposit interest rates, with reductions ranging from 0.1% to 1% per year depending on the term, aligning with the SBV’s directive to keep interest rates low to support businesses and individuals.

In the foreign exchange market, the USD has weakened significantly since the beginning of 2025 due to concerns about slowing economic growth and uncertain trade prospects caused by President Trump’s tariff policies. The DXY index dropped sharply from 108 points to below 100 points. Despite this, the VND has depreciated against the USD, with the USD/VND exchange rate increasing by over 2% since the beginning of the year, surpassing the 26,000 VND threshold for the first time. Given the low foreign exchange reserves, which cover only about 2.4 months of imports, the SBV will find it challenging to intervene strongly to stabilize the exchange rate. The movements of exchange rates and interest rates will need to be closely monitored in the coming period, influenced by US government actions.

Currently, the market’s attention is on the fluctuations in gold prices both internationally and domestically. Gold prices began to rise sharply since the escalation of the Russia-Ukraine conflict and continued to increase from early 2024 when gold prices exceeded the 2,000 USD/ounce mark. As of now, global gold prices have reached 3,300 USD/ounce, up 27% since early 2025, while domestic gold prices have reached 120 million VND/tael for the first time, nearly doubling in the past two years. Consequently, gold has surpassed the S&P 500 to become one of the most profitable asset storage channels since early 2023 (Chart 11).

Challenges and opportunities from US Tariff Policies in the Trump 2.0 Era

On April 2, 2025, President Trump announced an order imposing reciprocal tariffs on 180 economies to address the significant trade deficit and revitalize domestic manufacturing. Alongside a 10% base tariff applied to all countries, those with the largest trade deficits with the US will face higher tariffs, effective from April 9, 2025, with Vietnam subjected to a 46% tariff. Following negotiations with several countries, President Trump decided to temporarily delay the imposition of these tariffs for 90 days for most countries, except for China, which saw its tariffs raised to 145%, while China imposed a 125% tariff on US imports.

This isn’t the first instance of a trade war. During the first US-China trade war in 2018, Vietnam benefited as FDI enterprises accelerated the diversification of global supply chains to reduce reliance on Chinese goods. Vietnam’s overall trade balance increased from USD 6.8 billion in 2018 to USD 24.8 billion in 2024, with the trade surplus with the US tripling from USD 34.8 billion in 2018 to USD 104.4 billion in 2024.

This new tariff policy impacts many countries and will have a broader effect on global trade, disrupting supply chains in the short term and potentially reversing the globalization process pursued in recent decades. We believe Vietnam will also face short-term impacts, as concerns about tariff risks may slow down foreign investment registration and disbursement, affecting exchange rates and macroeconomic stability. However, these challenges provide Vietnam with the motivation to reform its domestic manufacturing sector, reduce dependence on raw materials from China, increase localization rates, and improve the quality standards of export products. Additionally, Vietnam needs to build a more balanced economic model, diversify export markets, and create a more resilient economy.

Positive outlook for a new era following administrative unit merger and government streamlining

According to Resolution No. 176/2025/QH15 passed by the National Assembly, the Government’s organizational structure will be streamlined to 14 ministries and 3 ministerial-level agencies, reducing the number by 5 ministries. Additionally, Resolution 60-NQ/TW has decided to reduce the number of provincial administrative units from 63 to 34, comprising 28 provinces and 6 centrally governed cities, and eliminating district-level governments. Furthermore, ministries, sectors, and localities are required to reduce their personnel by at least 20%.

This reform is considered the most significant in Vietnam since the “Doi Moi” reforms in 1986, aiming to streamline the administrative apparatus, expand development opportunities for localities, and enable the government to address issues faced by citizens and businesses more directly and effectively. The goal is to boost economic growth and improve living standards. This reform is particularly crucial as the economy needs to adapt flexibly to fluctuations in US tariffs, and the role of public investment as a growth driver becomes more important than ever. Additionally, resolving long-standing issues in the real estate market will help unlock resources to support growth.

Download the full report

Contact us

Our advisor will contact you as soon as possible

By subscribing you agree to with our Privacy Policy.

Explore more about our solutions

About RatingsRelated Post

Vietnam’s Economy in 2025: Growth Momentum Shaping a New Phase Key macroeconomic highlights of Vietnam in 2025: Vietnam concluded 2025 with an impressive GDP growth rate of 8.02% YoY, successfully meeting the National Assembly’s ambitious growth target. This marked the highest level of economic expansion in the past 15 years, excluding the exceptional post-pandemic rebound

Vietnam’s Economy in Q3/2025: Strong Growth Supported by Low Interest Rates Vietnam’s GDP surged 8.23% YoY in Q3, bringing nine-month growth to 7.85%, the second-highest in 15 years, only behind the surge in 2022. Industrials and Construction (+8.69%) led the expansion, with Manufacturing (+9.92%) and Construction (+9.33%) posting robust gains. Services (+8.49%) and Agriculture (+3.83%)

Join our newsletter

Subscribe for the latest updates and news.