3Q2025 Corporate Bond Bulletin

October 22, 2025

Q3/2025 Corporate Bond Market: Record Early Buybacks Amid Cooling Issuance

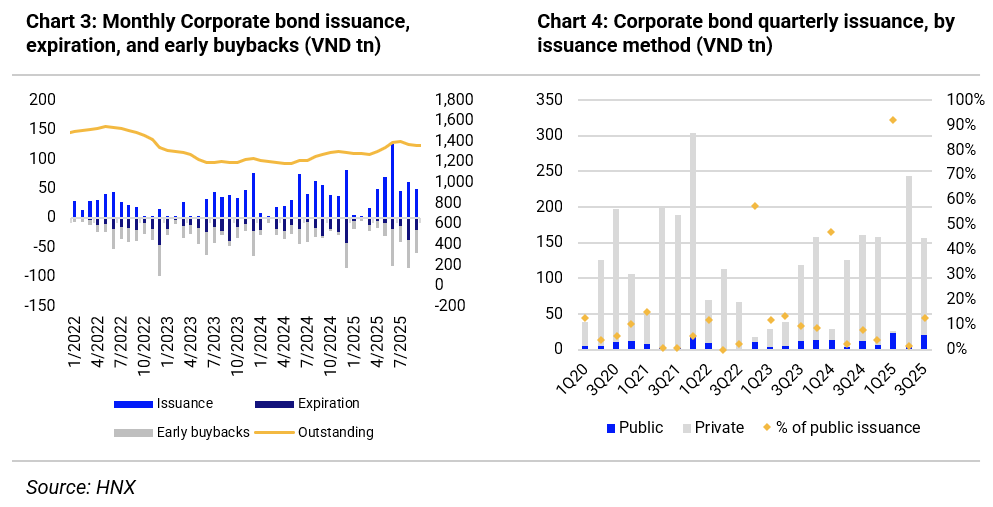

Corporate bond issuance in Q3/2025 totaled VND 156.1 trillion across 154 domestic deals and one international issuance by VPBank (USD 300 million), down 33% from Q2 but flat year-on-year. Activity cooled after a strong Q2 driven by major banks raising capital. Private placements still dominated (86%), while public offerings reached VND 20.4 trillion across 10 deals, with notable participation from CII and SBT apart from the financial sector.

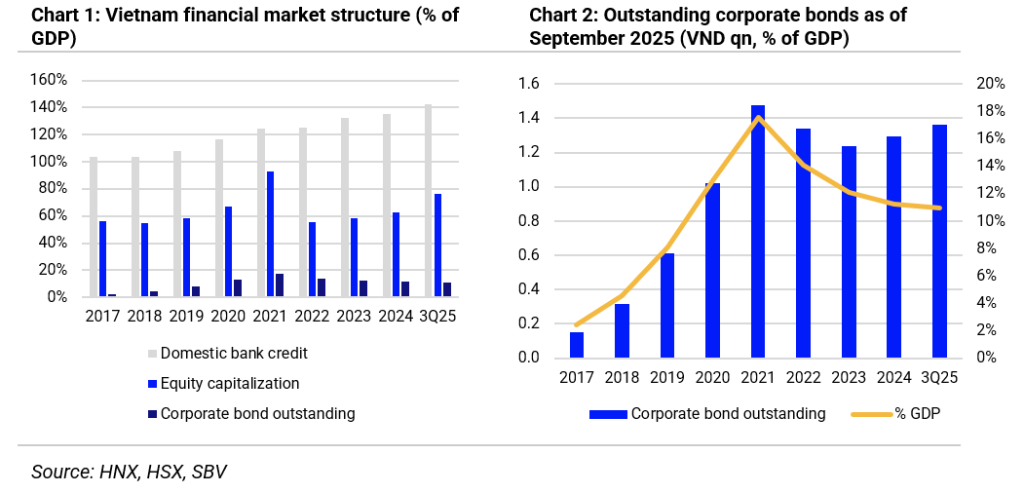

For the first nine months, issuance reached VND 432.5 trillion (+37% YoY). However, with VND 122.8 trillion in maturities and VND 235.6 trillion in early buybacks, outstanding bonds rose only 5.7% YTD to VND 1.36 quadrillion—equivalent to 11% of GDP. Most issuances were for refinancing rather than new capital, leaving the corporate bond market relatively small compared to credit and equities. We expect the ongoing legal reforms will gradually restore investor confidence and support sustainable growth of the bond market.

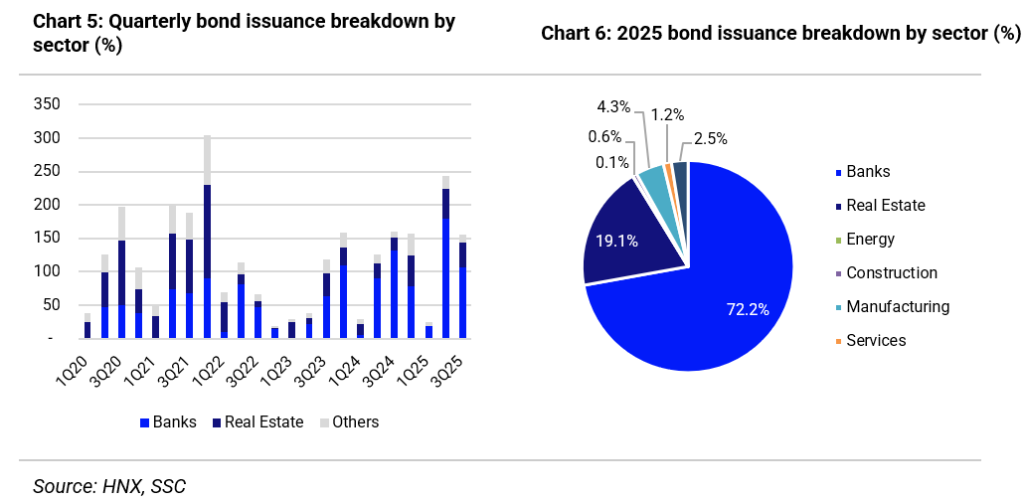

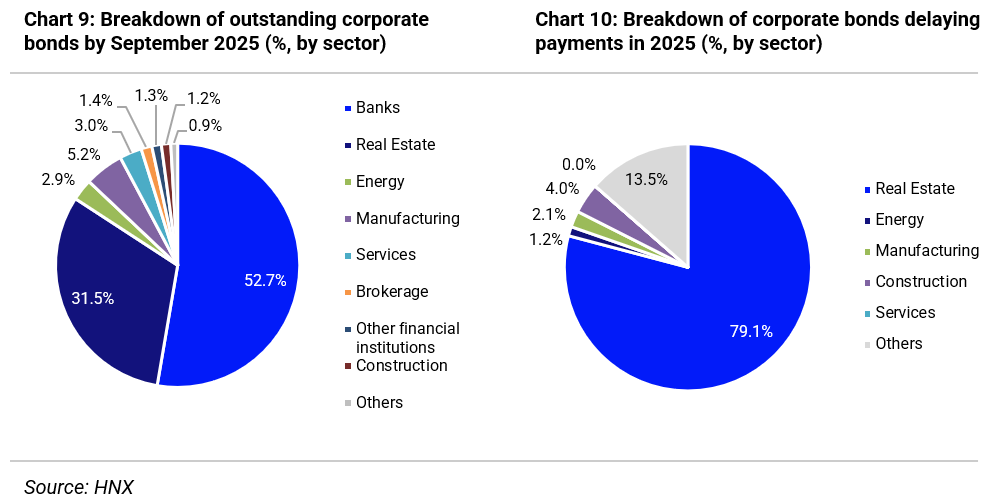

Sector Breakdown: Banks and Real Estate dominated issuance, accounting for 72% and 19% respectively. Key issuers included Agribank (VND 17.5 trillion), OCB (VND 16.2 trillion), Vinhomes (VND 15 trillion), and MB Bank (VND 12.1 trillion).

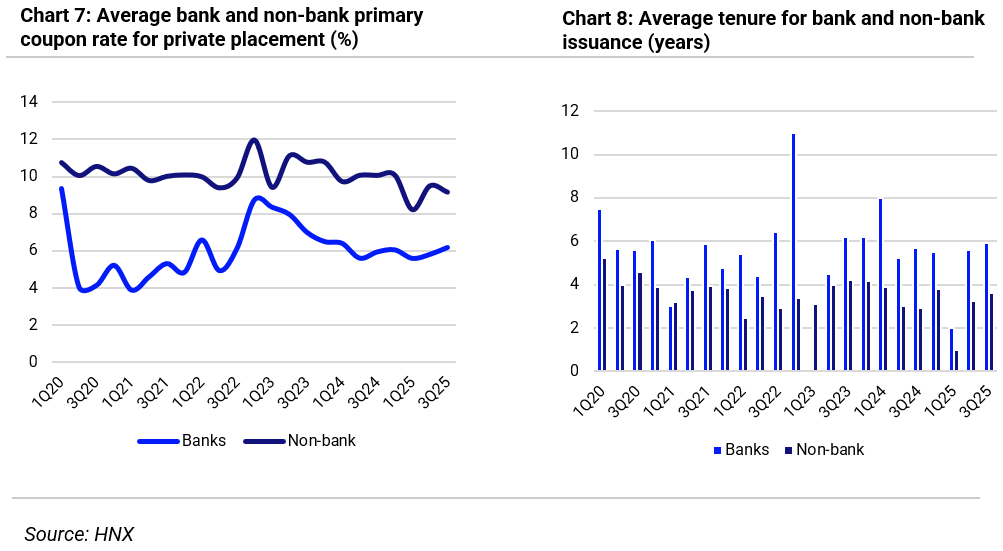

Coupon Trends: Bank coupon rates rebounded to average 6.18% in Q3—the highest in six quarters—while tenors extended to 5.9 years. This reflects rising funding needs amid accelerating credit growth. Bank issuance surged 38.1% YoY in the first nine months. Conversely, Real Estate and Manufacturing issuers saw coupon declines of 50–150 bps, supported by improved business conditions and regulatory reforms. Examples include Vingroup/Vinhomes (from 12.5% to 11%) and Văn Phú Invest (from 11% to 10%), Vietjet and Thanh Thanh Cong – Bien Hoa also recorded positive declines in coupon rates. Improved business conditions and a warming real estate market, supported by new legal regulations that promote market health, have significantly improved credit risk assessments for these companies this year.

Debt Restructuring: Early buybacks hit a record VND 112 trillion in Q3, while maturities rose to VND 72 trillion. Year-to-date, early buybacks and maturities totaled VND 358.4 trillion—84% of new issuance. Extensions also increased, with VND 35 trillion restructured in nine months. Despite these efforts, payment delays persist, with VND 62 trillion (5% of market outstanding) overdue. Q3 saw 37 additional delayed bond lots, mainly from large issuers such as Novaland, BCG, Hung Thinh, Van Thinh Phat, Sunshine, and Hoang Anh Gia Lai.

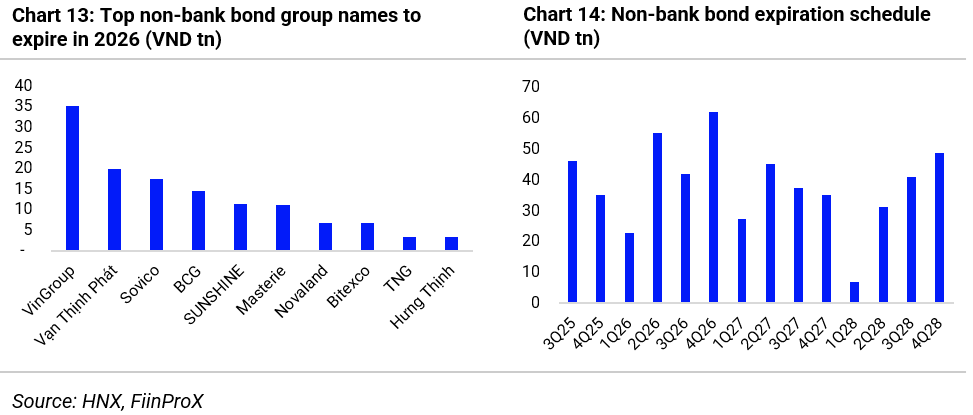

Market Outlook for Late 2025 and 2026: Record Real Estate Bond Maturities Ahead

Bond maturities are expected to remain high in Q4/2025 at VND 62 trillion, though pressure on the Real Estate sector will ease as its maturities decline 49% from Q3 to VND 19.3 trillion. In 2026, maturities will start lower in early quarters but rise sharply toward year-end, totaling VND 233 trillion for the year (+26% YoY). Notably, 2026 will be particularly challenging for Real Estate, with a record VND 141 trillion maturing—an 81% increase versus 2025.

We anticipate strong issuance activity in 2026, especially from Real Estate firms. However, Decree 245/2025/NĐ-CP, effective September 11, 2025, mandates credit ratings for all issuers or bonds registered for offering (except credit institutions and fully guaranteed bonds). While this may slow primary market issuance in the short term as issuers prepare documentation, it will enhance transparency and investor confidence, supporting sustainable market growth in the long run.

Download the full report

Contact us

Our advisor will contact you as soon as possible

By subscribing you agree to with our Privacy Policy.

Explore more about our solutions

About RatingsRelated Post

1Q2025 Overview: Positive signals from public bond issuance channel According to S&I Ratings estimates, 1Q2025 saw 13 bond issuance rounds totaling VND 25.1 trillion. This includes 11 rounds of public issuance (VND 23.1 trillion) and 2 rounds of private issuance (VND 2 trillion). The bond issuance value increased by 4.7% compared to the same period

Join our newsletter

Subscribe for the latest updates and news.