2025 Banking Sector Outlook: Balancing Growth and Efficiency

June 2, 2025

Key Highlights from Banks’ 2025 business plans

Vietnamese banks have released their business plans for 2025 at their AGMs, with small-sized joint stock commercial banks (JSCBs) are targeting the highest PBT growth (up 106% YoY, excluding NVB), followed by mid-sized JSCBs (up 20% YoY), and large-sized JSCBs (up 17% YoY). Meanwhile, among state-owned commercial banks (SoCBs), only VCB has received approval for 2025 PBT growth, with a modest target of +3.5% YoY. BID and CTG are still waiting for approval of their profit plans from SBV, with BID has set a goal to strive for PBT of 6 – 10% this year. We note that SoCBs and some large banks such as ACB, TCB, MBB, and STB have set relatively cautious business plans for 2025, whereas VPB, HDB, and OCB have more aggressive growth plans (though most have not yet factored in the risk of high reciprocal tax rates from the US). Although credit growth is expected to be strong at some banks such as HDB (+32% YoY), MBB (+12.7% YoY), and MSB (+20% YoY), the PBT growth targets are slightly lower (HDB: +27%, MBB: +10%, MSB: +16%), reflecting conservative NIM assumptions in the context of increasing competitive pressures.

Regarding asset quality, SoCBs continue to target NPL ratios significantly lower than the sector average (below 1.4–1.8%), while JSCBs aim to control NPL under 2–3% depending on each specific bank. To maintain capital increase, most banks have chosen not to pay cash dividends. However, we observe that the number of banks paying cash dividends has increased compared to last year (including LPB, VIB, ACB, MBB, VPB, TPB, and OCB), indicating a balance between short-term shareholder benefits and long-term strategies. Meanwhile, some other banks (especially SoCBs like VCB and BID) have mentioned plans to raise charter capital through private placements, facing strong pressure to maintain capital adequacy in the near future.

A notable new trend this year is banks’ plans to strengthen their wealth management segments. Some large banks like VPB and TCB plan to establish life insurance companies, while STB and MSB expect to acquire securities companies this year to expand their financial ecosystems. Despite economic challenges, the potential of the wealth management sector in Vietnam remains substantial. According to McKinsey, the compound annual growth rate (CAGR) of personal financial assets in Vietnam during 2011–2021 reached 15%, far exceeding the 7% growth in other Asian countries. By 2027, Vietnam’s wealth management market is expected to reach a size of USD 600 billion, growing strongly from USD 360 billion at the end of 2022 — equivalent to an annual growth rate of 11%. The banking sector is well-positioned to penetrate deeper into this segment, thanks to its existing advantages in distribution networks and large customer base. Integrating more financial products (insurance, securities) into their ecosystems will allow banks to offer more comprehensive financial solutions for customers, aiming to expand the wealth management segments. We believe this trend is especially important for diversifying income streams, increasing fee-based revenues and reducing reliance on NIM amid fierce competition and NIM compression.

Overall, business plans for 2025 released by banks are moderately positive amid ongoing difficulties and uncertainties, stemming from both external factors (tariff risks) and internal pressures as NIM continues to narrow. Banks with strong capital buffers, low funding costs and stable asset quality are likely to maintain better growth trajectories compared to their peers in 2025.

Credit Growth

In 2025, the State Bank of Vietnam (SBV) has set a credit growth target of 16% (higher than the 15.08% growth recorded in 2024 and at a relatively high level compared to recent years) to align with the government goal of achieving GDP growth above 8%.

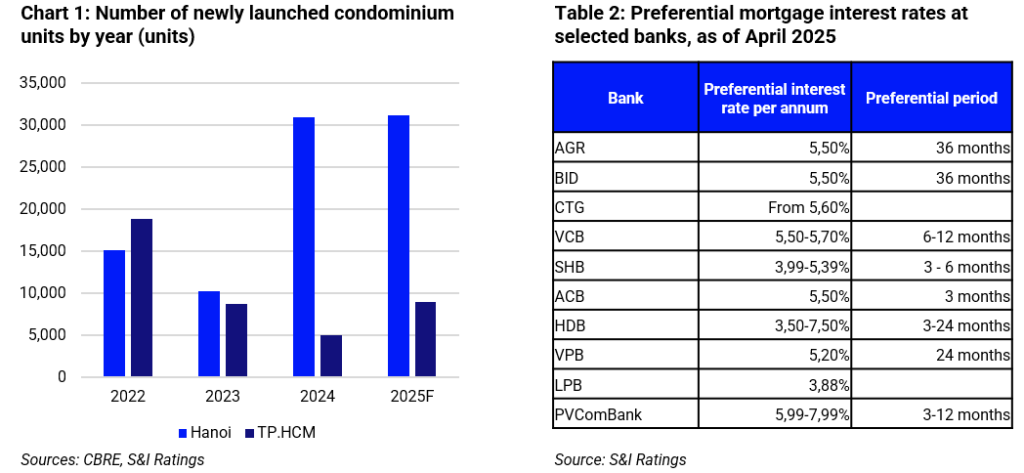

Entering 2025, we observe some positive signals suggesting that mortgage lending could grow better than in the previous year, thereby driving growth in the consumer credit segment. Firstly, many banks have launched preferential home loan packages with interest rates lower than those at the end of 2024. A positive point is that some of these loan packages are more attractive and practical for borrowers, with preferential interest rates applied for up to three years, particularly at state-owned banks such as AGR and BID (see Table 2). Secondly, according to CBRE data, the supply of newly launched condominium is expected to increase sharply in the Northern region (about 31,200 units) and improve in the Southern region (about 9,000 units, up 78% compared to 2024). On the other hand, we also note that housing prices remain at high levels, exceeding the affordability of the majority of the population. As such, a more pronounced recovery in the real estate market may only materialize when the economy shows clear signs of a strong resurgence.

We believe that consumer credit will gradually recover this year but is unlikely to see a major breakthrough. Credit growth in 2025 will still primarily come from lending to corporate customers, driven by traditional growth engines — particularly in public investment, infrastructure, and manufacturing — which are key growth drivers being actively promoted by the Government and SBV in 2025. Therefore, credit growth is expected to reach 16% YTD in 2025.

Asset Quality

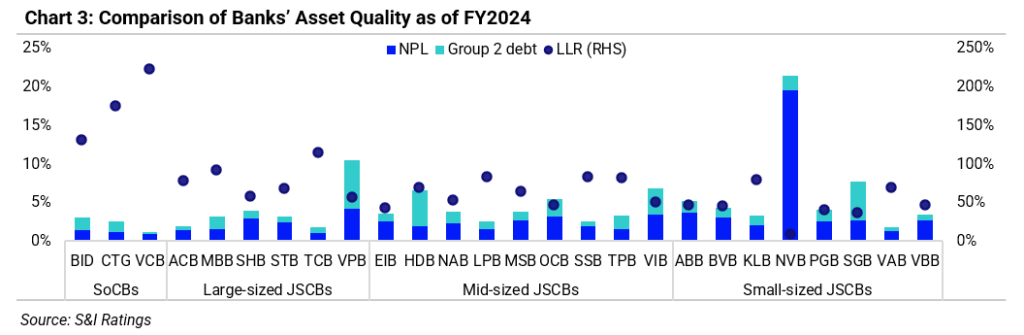

In 2025, we expect the real estate market to continue mild recovery, helping improve market sentiment and attract new investment flows — especially in the southern VN, which has experienced a prolonged period of subdued activity. This, in turn, should improve cash flows for real estate developers. With the Government’s strong commitment to resolving legal bottlenecks in the real estate market, we also expect some previously stalled projects to be cleared and restarted this year, thereby supporting banks in encouraging homebuyers to repay their loans. However, it is important to emphasize that the underlying issue is real estate developer cash flow and the trust of homebuyers and investors. If developers continue to fail in fulfilling purchase agreements and/or delivering homes on schedule, bad debts from individual borrowers may increase. Another factor we highlight is that SMEs are still facing considerable challenges in operational cash flow, as the business environment has yet to show significant improvement and domestic consumer demand remains weak. This could affect their repayment capacity and lead to higher risks of NPL within this segment. On the other hand, credit costs declined to 1.12% in 2024 (from 1.23% in 2023) mainly because banks no longer made high provisioning as in previous periods. Loan loss reserve ratio (LLR) dropped from over 130% during 2021–2022 to just above 90% by the end of 2024. We believe banks will gradually increase LLR ratios again to rebuild risk buffers. As such, credit costs are not expected to continue declining this year.

Overall, we expect the sector-wide asset quality to improve slightly in 2025 from the 1.92% level recorded in 2024. One key variable will be the potential imposition of higher tariffs on Vietnamese exports to the US, which could have more impact in the second half of the year. At the same time, the absorption capacity of homebuyers remains a major risk, as new supply is heavily concentrated in the high-end segment. Despite these ongoing challenges, we believe that the Government’s firm commitment to implementing bold measures to stimulate key growth drivers will gradually help restore market sentiment and improve the business environment.

Profitability

Net interest margin (NIM) is expected to remain under prolonged pressure in 2025, as funding costs are unlikely to improve despite stronger projected credit growth. We believe fierce competition among banks will limit their ability to pass on higher funding costs to borrowers, especially among JSCBs. In this context, several banks have introduced auto-earning products (i.e interest-earning current accounts, auto investment linked accounts) to attract CASA by offering slightly higher interest rates than traditional non-term deposits. Examples include TCB’s “Sinh lời tự động 2.0”, VPB’s “Super sinh lời”, VIB’s “Siêu lợi suất”, and LPB’s “Sinh lời Lộc Phát”. In general, the primary goal of these products is to expand CASA balances and thus reduce overall funding costs. However, if the product design is suboptimal or interest rates are not well managed or if banks engage in a rate race, it could lead to higher funding costs and adversely affect NIM.

In addition, NIM will remain under pressure as banks are expected to maintain or even lower lending rates to support the conomy, in line with government directives. Smaller banks will be more heavily impacted due to weaker deposit mobilization capabilities and a greater reliance on interbank funding. Overall, we expect NIM to continue its downward trend in 2025, although the impact will vary across bank groups. NIM is projected to remain relatively stable among SoCBs and larger banks thanks to their cost of funds advantage and ability to expand market share amid recovering credit demand. However, SoCBs may face greater NIM compression than large-sized JSCBs, as they are more involved in implementing large-scale preferential credit loans for both individuals and businesses as mandated by SBV and the government. In contrast, small and mid-sized JSCBs will likely see a more notable decline in NIM due to rising funding costs and intense competition in loan pricing. We estimate sector-wide NIM will decline in 2025 with only mild changes for SoCBs and large banks, while mid- to small-sized JSCBs may experience a drop of 10–15 basis points.

Amid narrowing NIM, non-interest income is expected to maintain solid growth, driven primarily by continued strong recoveries from bad debts. Banks recorded substantial profits from bad debt recovery in 2024 (up VND 15.96 trillion or +71% YoY). We project this income stream will continue to increase in 2025 as banks accelerate bad debt recovery efforts, especially if Resolution 42 is successfully codified into law. On the other hand, we believe that fee income growth will be relatively subdued due to (i) intense competition among banks pushing service fees lower to attract customers, and (ii) bancassurance — while showing signs of recovery — is unlikely to generate profit contributions as strong as the pre-2022 period. In addition, the sharp appreciation of VND/USD in 2024 helped banks improve foreign exchange trading income (+8.9% YoY) and we expect this trend to continue in 2025 as exchange rate volatility persists. Meanwhile, bond trading income is expected to remain flat, with limited upside in 2025 as there is little room for interest rates to decline further – constraining banks’ ability to realize profits from buy – sell price differentials.

Update on 1Q2025 Business Results

Credit growth in 1Q2025 started off on a positive note, increasing by 3.8% YTD – significantly higher than the same period in 2024 (+1.9%) and only slightly below 1Q2023 (+3.9%). This strong growth was seen across most banks, reflecting the sector’s effort to boost credit early in the year in alignment with the Government’s GDP growth target of over 8%. However, a less favorable point is that sector-wide cost of funds rose by 19 basis points compared to end-2024, while average asset yield saw a slight decline of 3 basis points.

Asset quality deteriorated again. The sector-wide NPL ratio rose from 1.92% at the end of 4Q2024 to 2.1% in 1Q2025, with uneven increases across banks. Notably, banks with significant NPL upticks included TPB, OCB, SGB, and VPB – most of which have a high retail lending exposure – as well as SoCBs such as BID and CTG. Group 2 debts (special mention debts) also rose sharply at several banks, including VAB, SGB, HDB, BVB, TPB, and LPB. Despite worsening asset quality, the banking sector’s LLR ratio declined sharply to 80% by the end of 1Q2025 (from 91% at the end of 2024), marking the lowest level since 2018. The LLR ratio dropped significantly at both SoCBs (BID, CTG) and JSCBs such as TPB, MBB, and HDB.

NIM continued to narrow. In 1Q2025, NIM fell to 3.31% – the lowest level since 2019 – down 12 basis points YoY. The sharpest NIM contractions were seen at SoCBs and large JSCBs, declining by 12 bps and 10 bps YoY, respectively. One reason was that since late 2023, SoCBs had launched numerous preferential loan programs, prompting JSCBs to follow suit to remain competitive. Banks continued to accelerate non-interest income activities to offset the impact of declining NIM. In particular, recoveries from previously written-off bad debts maintained strong growth (+44% YoY), with most of this income continuing to come from banks primarily operating in northern VN, including SoCBs in general as well as MBB, TCB, VPB, SHB, and TPB.

Download the full report

Contact us

Our advisor will contact you as soon as possible

By subscribing you agree to with our Privacy Policy.

Explore more about our solutions

About RatingsJoin our newsletter

Subscribe for the latest updates and news.