Vietnam Macro Bulletin 3Q2025

October 15, 2025

Vietnam’s Economy in Q3/2025: Strong Growth Supported by Low Interest Rates

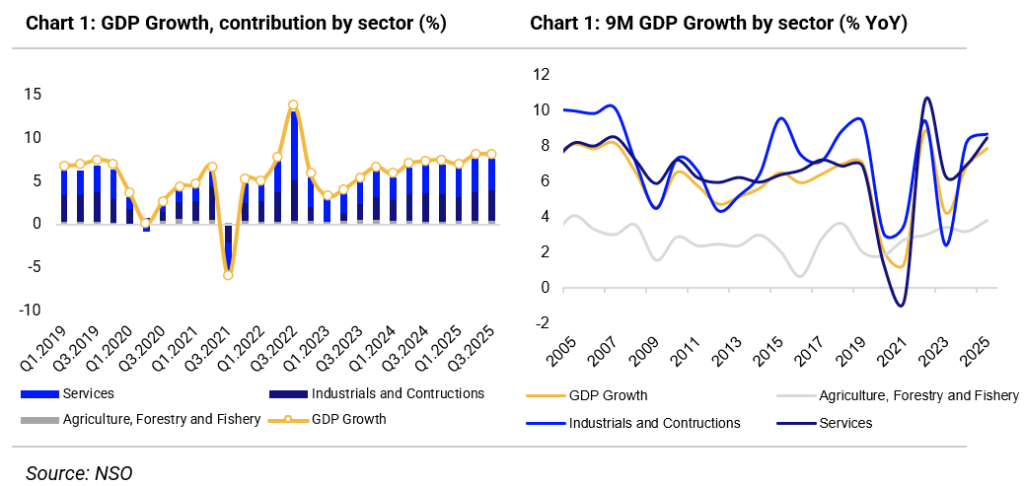

Vietnam’s GDP surged 8.23% YoY in Q3, bringing nine-month growth to 7.85%, the second-highest in 15 years, only behind the surge in 2022. Industrials and Construction (+8.69%) led the expansion, with Manufacturing (+9.92%) and Construction (+9.33%) posting robust gains. Services (+8.49%) and Agriculture (+3.83%) also recorded their strongest growth since 2008 (excluding the exceptional spike in 2022). Key sectors such as Transportation (+10.68%), Hospitality & Food Services (+10.15%), and Entertainment (+11.13%) saw double-digit increases.

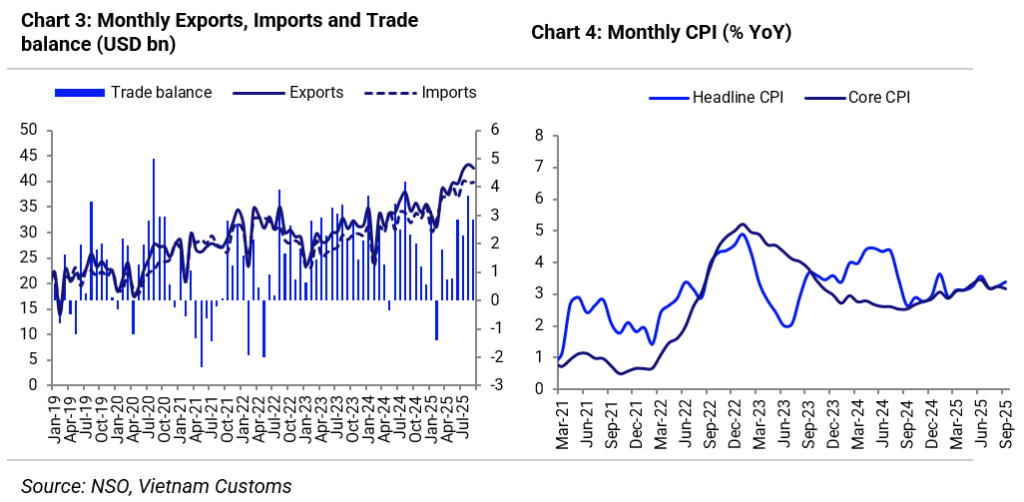

Trade remained resilient despite US tariff challenges. Import-export value rose 17.3% YoY in the first nine months, with exports up 16%, imports up 18.8%, and a trade surplus of USD 16.82 billion. Exports to the US grew 27% in Q3, while imports from China jumped 30.2%.

Tourism continued its recovery, with international arrivals up 21.5%, driven by Chinese visitors (+43.9%), reclaiming the top spot among source markets. Retail sales grew 7.2% after inflation adjustment.

Looking ahead, this positive growth trend is expected to continue in Q4, likely surpassing the full-year GDP target of 8%. The Ministry of Finance projects Vietnam will meet or surpass all 15 socio-economic targets for 2025, paving the way for double-digit growth in 2026–2030, supported by institutional and infrastructure reforms.

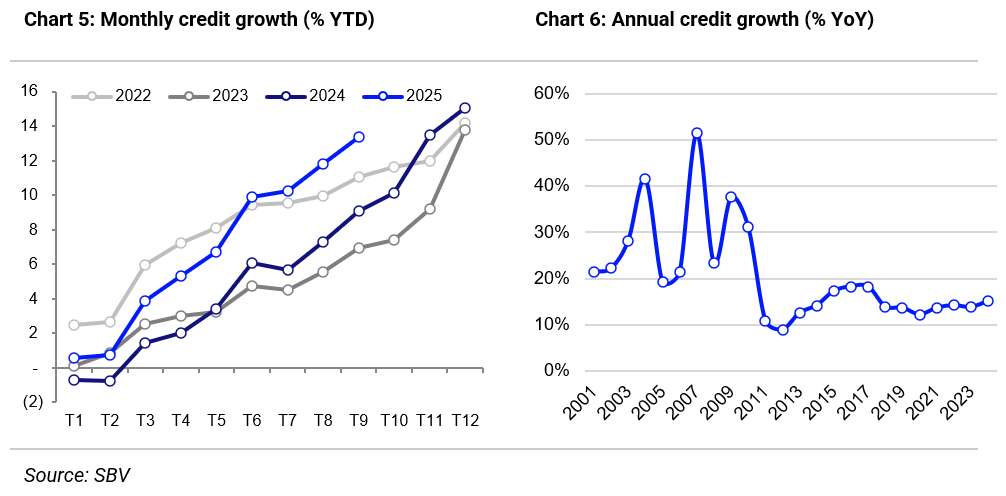

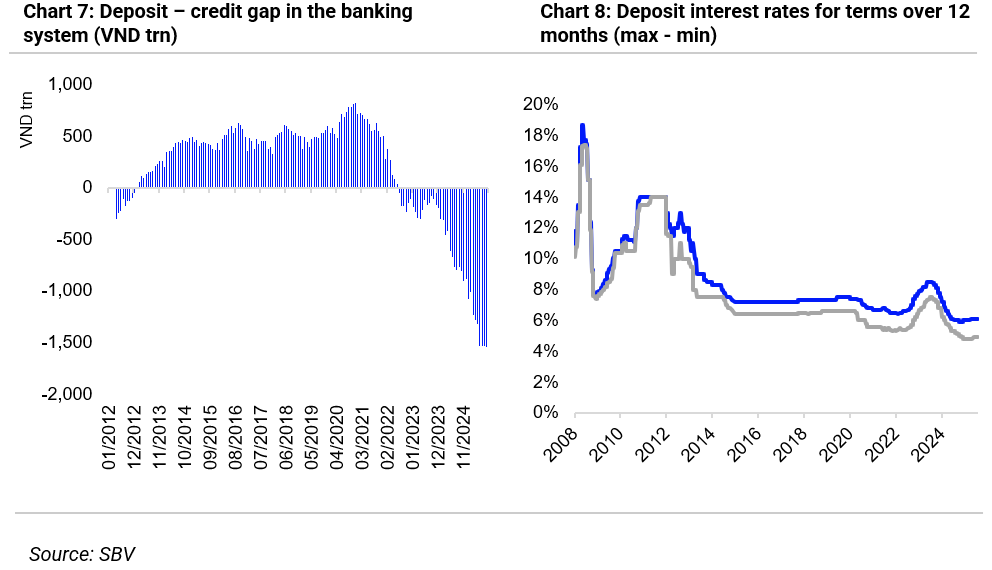

Maintaining Low Interest Rates to Support Business Activities

Interest rates remained at historically low levels in Q3. Short-term deposit rates (under six months) rebounded to 3.4%–4.1% after a sharp decline in Q2, while long-term rates (over 12 months) stayed at record lows of 4.9%–6.1%. Persistently low interest rates since the beginning of the year have fueled strong credit growth, which reached 13.37% by the end of Q3—the highest in a decade—while deposit growth lagged at 9.74%. Given this trend, commercial banks may need to slightly raise deposit rates to attract funds and moderate credit expansion. However, any increase is expected to remain modest to continue supporting production and business activities.

Exchange Rate: Significant Increase but Under Control

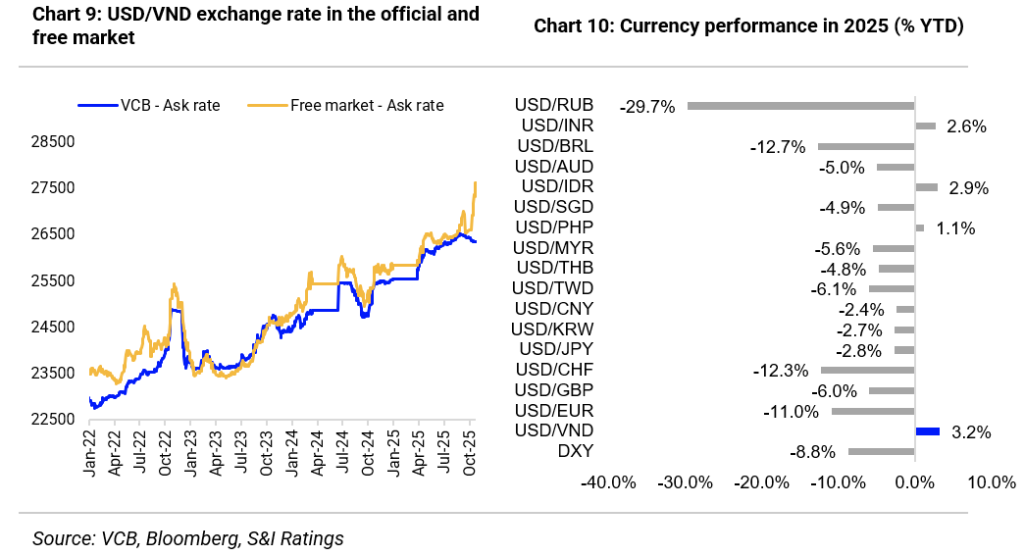

Since the start of 2025, the Vietnamese dong (VND) has depreciated by over 3% against the U.S. dollar (USD), diverging from the strengthening trend of many other currencies as the U.S. Dollar Index (DXY) has fallen more than 9% (Chart 10). This has led to a sharp decline in VND’s value relative to major currencies: EUR/VND up 16%, GBP/VND up 9.7%, JPY/VND up 6.2%, and CNY/VND up 5.8%.

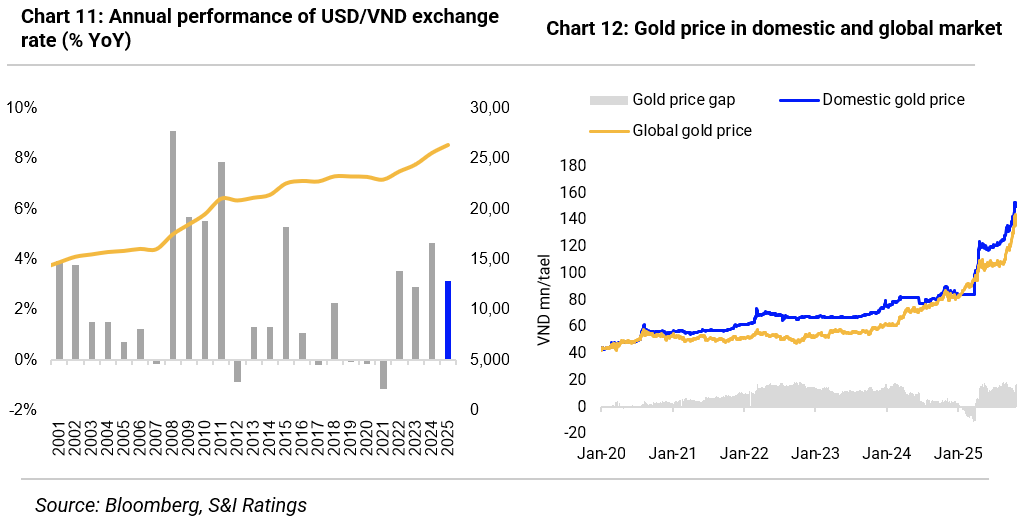

In October, the official exchange rate began to cool and stabilize. However, the free market rate faced renewed pressure, rising nearly 5% in less than a month and surpassing 27,700 (Chart 9). This surge was driven by increased demand for USD among the public and may have been indirectly influenced by the continuous rally in gold prices (Chart 12). Nevertheless, movements in the free market tend to be localized and have limited impact on the official rate.

Looking ahead, we expect the exchange rate to remain more stable through year-end. Key supportive factors include the Federal Reserve’s continued interest rate cuts and an increase in foreign currency supply from export revenues and remittances. These dynamics should help keep the annual exchange rate increase below 5%.

Download the full report

Contact us

Our advisor will contact you as soon as possible

By subscribing you agree to with our Privacy Policy.

Explore more about our solutions

About RatingsRelated Post

Vietnam’s Economy in 2025: Growth Momentum Shaping a New Phase Key macroeconomic highlights of Vietnam in 2025: Vietnam concluded 2025 with an impressive GDP growth rate of 8.02% YoY, successfully meeting the National Assembly’s ambitious growth target. This marked the highest level of economic expansion in the past 15 years, excluding the exceptional post-pandemic rebound

Q1 Production and consumption activities show positive growth GDP growth reached 6.93% YoY in 1Q2025, the highest increase in Q1 since 2020 (Chart 1). This positive result mainly stems from growth momentum in the manufacturing and tourism sectors, with key industries such as manufacturing (+9.3% YoY), hospitality and food services (+9.3% YoY), construction (+8% YoY),

Join our newsletter

Subscribe for the latest updates and news.