Vietnam Macro Bulletin 4Q2025

January 20, 2026

Vietnam’s Economy in 2025: Growth Momentum Shaping a New Phase

Key macroeconomic highlights of Vietnam in 2025:

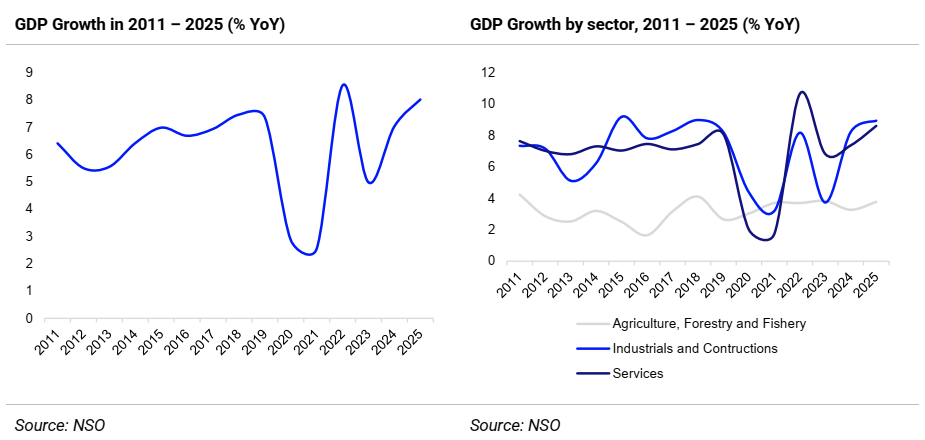

- GDP growth accelerated to 8.46% YoY in Q4 2025, bringing full-year GDP growth to 8.0% YoY, the second-highest level since 2011.

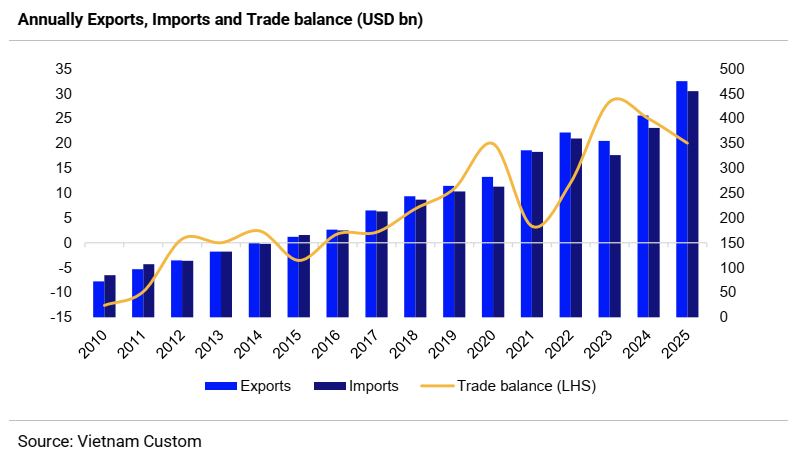

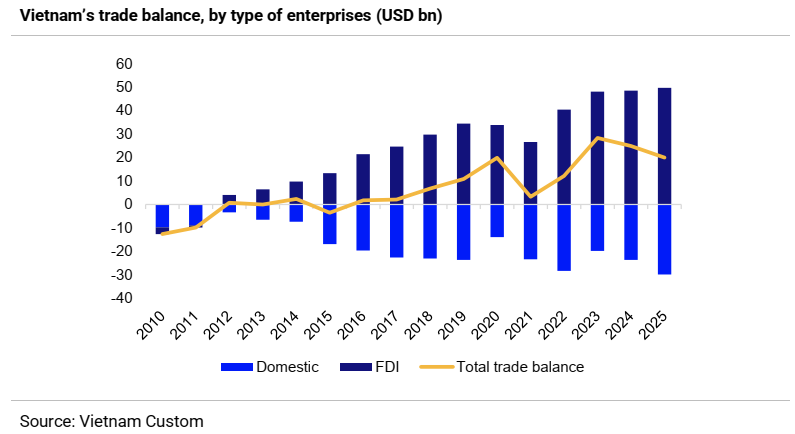

- Exports emerged as the primary growth driver, expanding by 17% YoY in 2025 and generating a trade surplus of USD 20 billion.

- Inflation remained well contained at 3.3%, below the National Assembly’s target of 4.5%, reflecting effective macroeconomic management.

- Retail sales grew by 9.2% YoY, supported by a strong recovery in: Tourism activities (+20% YoY), and Hospitality and food services (+14.6% YoY).

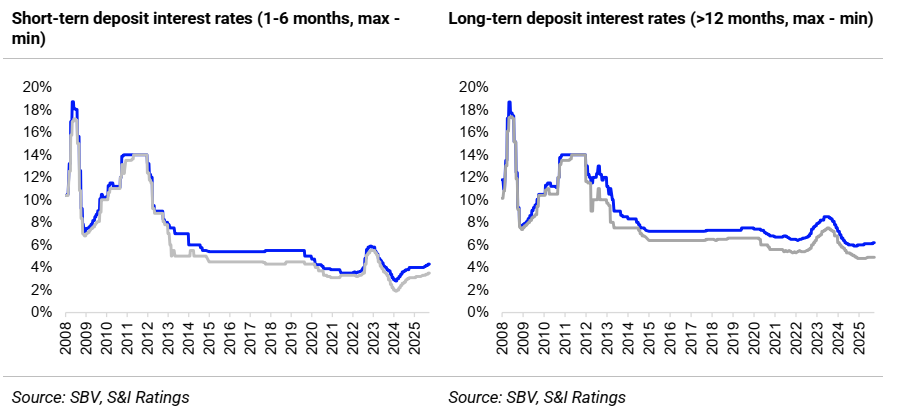

- Interest rates continued to be maintained at low levels, in line with the Government’s accommodative policy stance to support economic activity. However, deposit rates edged up slightly toward year-end.

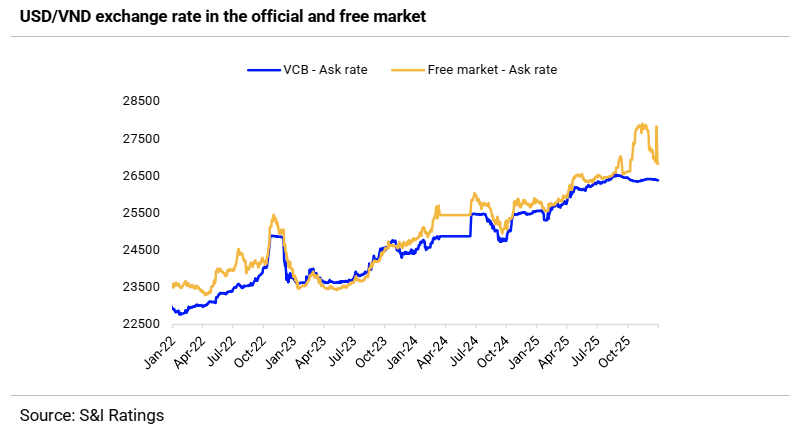

- The USD/VND exchange rate depreciated by 3.2% compared to end-2024. Exchange rate pressures are expected to ease in 2026, as anticipated Fed rate cuts help restore a positive VND–USD interest rate differential.

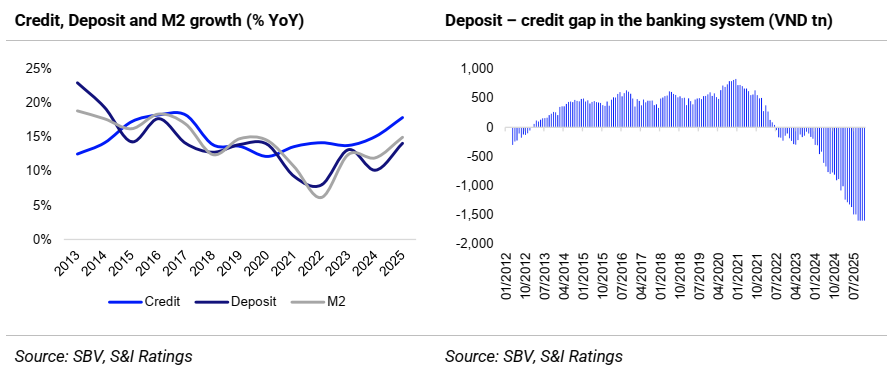

- Credit growth reached 17.87% as of 24 December 2025, outpacing deposit growth of 14.1%. By year-end, credit growth accelerated further to 19.01%, indicating robust borrowing demand and improved credit absorption.

Vietnam concluded 2025 with an impressive GDP growth rate of 8.02% YoY, successfully meeting the National Assembly’s ambitious growth target. This marked the highest level of economic expansion in the past 15 years, excluding the exceptional post-pandemic rebound recorded in 2022 (+8.47% YoY). Over the 2021–2025 period, Vietnam’s economy expanded at an average annual rate of 6.3%, slightly exceeding that of the preceding period (6.2%). Excluding 2021, which was heavily impacted by the Covid-19 pandemic, average growth reached 7.13% per year, surpassing the official target range of 6.5%–7.0%. Economic momentum strengthened notably toward the end of the year, with GDP growth accelerating to 8.46% YoY in Q4 2025. This performance highlights the Government’s more decisive policy implementation in the final stage of the 2021–2025 Socio-Economic Development Plan, reinforcing growth drivers at a critical juncture. These results also underscore Vietnam’s economic resilience in navigating a turbulent global environment, characterized by heightened international uncertainties and intensifying global trade pressures following the introduction of new tariff policies by the United States earlier in the year. Importantly, 2025 represents a pivotal transition year, as a series of structural and institutional reforms were initiated to lay a solid foundation for the 2026–2030 development phase. During this next cycle, Vietnam aims to achieve two-digit GDP growth, progress toward upper-middle-income status, and strengthen its position as one of the leading economies in the region.

Manufacturing and Exports as Key Growth Drivers

In Q4 2025, Vietnam’s GDP expanded by 8.46% YoY, marking the strongest fourth-quarter growth since 2011. The industrial sector grew by 9.73% YoY, contributing 45.8% of overall quarterly growth, led by the manufacturing industry, which recorded a robust 10.56% YoY increase and continued to serve as the backbone of the economy.

Among manufacturing subsectors, chemicals, metals, pharmaceuticals, textiles and garments, food products, and motor vehicles all posted double-digit growth rates. The electronics sector, meanwhile, entered a more stable phase, expanding by 9.2% YoY, reflecting a normalization from earlier high growth levels. Supporting services such as transportation and warehousing also performed strongly, with growth reaching 10.83% YoY in the quarter.

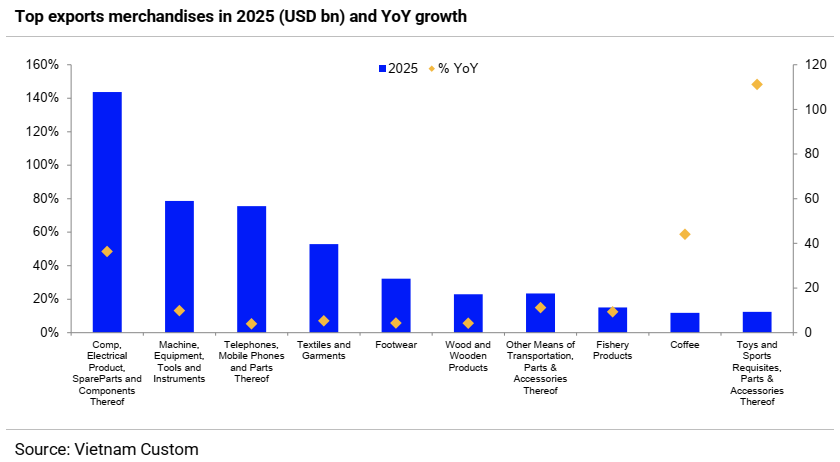

Trade performance emerged as the most notable upside surprise in 2025. Total two-way trade turnover reached USD 930 billion, representing a 18.2% increase YoY and equivalent to approximately 180% of GDP, resulting in a trade surplus of USD 20 billion. This outcome significantly exceeded expectations at the start of the year, particularly in light of challenges stemming from the United States’ implementation of new tariff measures, including a 20% reciprocal tariff applied to Vietnam, which posed considerable headwinds for Vietnamese exporters and global supply chains alike.

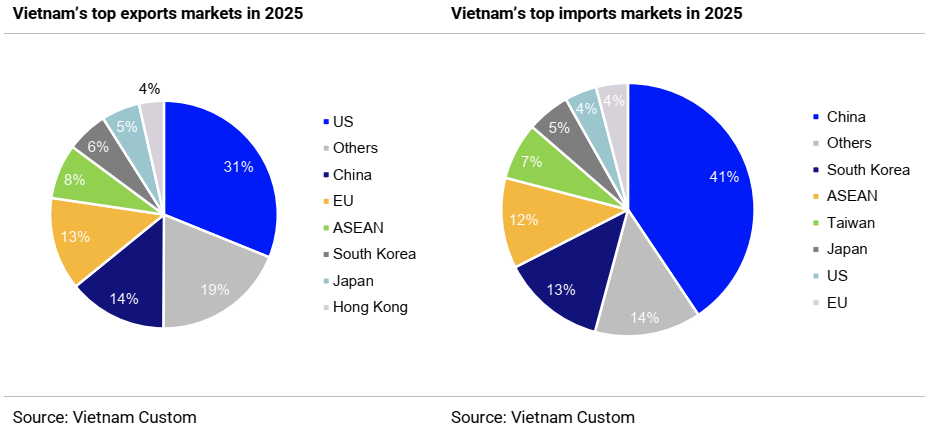

In full-year 2025, exports increased by 17% compared to 2024. The United States remained Vietnam’s largest export market, with total shipments reaching USD 153.1 billion, accounting for 32% of total exports. It was also the fastest-growing market (+28.2% YoY) and the largest contributor to overall export growth. Traditional export categories to the U.S.—including textiles and garments, footwear, wooden furniture, and seafood—continued to demonstrate solid resilience, posting growth rates of 5%–10%. However, the primary growth driver was electronics, which surged by 81% YoY, reflecting Vietnam’s deepening integration into global technology supply chains.

On the import side, imports expanded by 19.4% YoY in 2025, driven mainly by raw materials and intermediate inputs supporting domestic production activities. China remained Vietnam’s largest source of imports, accounting for 40% of total import value, while also posting the strongest growth rate (+29% YoY). In addition, imports from the United States rose sharply (+27.7%), following the establishment of new trade agreements. Overall, Vietnam demonstrated strong resilience against renewed trade pressures while further reinforcing its position within global value chains.

That said, within this broadly positive trade landscape, a clear divergence between the FDI sector and domestic enterprises remains evident. The FDI sector continued to dominate trade performance, capitalizing effectively on favorable conditions with export growth of 26.9% YoY and a trade surplus of USD 49.7 billion. In contrast, domestic enterprises faced mounting challenges, with exports contracting by 7.4% YoY and a trade deficit of USD 29.8 billion. Narrowing this gap will require Vietnamese firms to achieve breakthroughs in production capacity and competitiveness, enabling deeper participation in global supply chains.

Uneven Recovery in Domestic Consumption

In 2025, GDP growth in the services sector reached 8.82% YoY, accounting for the largest share of GDP and contributing 51% to overall economic growth. However, real retail sales of goods increased by only 6.7% YoY after adjusting for price effects, indicating that domestic demand has yet to achieve a strong and broad-based recovery capable of becoming a primary growth engine.

While headline inflation remained relatively stable at 3.31%, price increases in the two largest CPI components—food and housing—were more pronounced, weighing on purchasing power and dampening consumer spending across a wide segment of households.

Growth in the services sector was largely supported by the recovery in tourism-related activities, with hospitality and food services expanding by 10% YoY, alongside production-supporting services such as transportation and warehousing, which recorded growth of 10.8% YoY.

International tourism posted a record performance, with 21.2 million international arrivals in 2025, representing a 20.4% YoY increase. This strong rebound in inbound tourism also translated into a sharp acceleration in services exports, which rose by 18.9% compared to 2024.

Public Investment as a Key Growth Engine

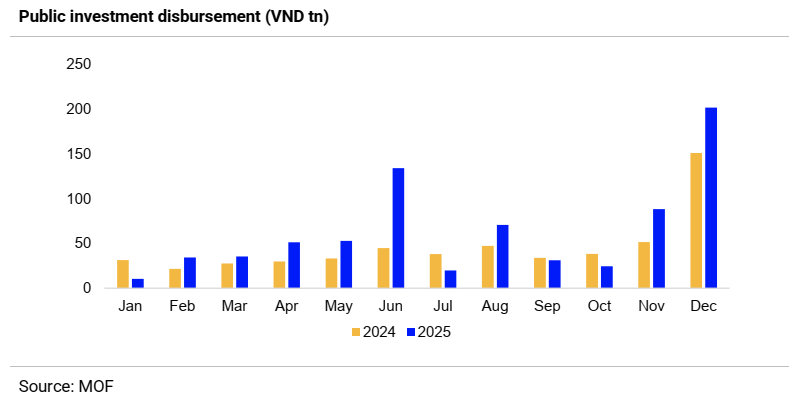

Amid limited remaining room for monetary policy easing, fiscal policy emerged as the primary pillar supporting economic growth. In 2025, public investment was significantly accelerated, underpinned by a series of important policy and institutional reforms.

The amended Law on Public Investment, which came into effect at the beginning of the year, introduced greater decentralization to local authorities, while simplifying appraisal procedures and adopting digitalized processes to reduce administrative overlaps. In parallel, the Government rolled out a nationwide online public investment management system, enabling real-time monitoring of project progress and disbursement, while also publicly disclosing project lists and disbursement data on the national portal to enhance transparency.

From a fiscal perspective, budgetary resources were prioritized for strategic infrastructure projects, including transport, energy, and digital transformation, alongside the introduction of advance funding mechanisms from subsequent budget years to expedite implementation. As a result of these reforms, the public investment disbursement rate in 2025 reached approximately 82.7% of the Prime Minister-assigned plan, equivalent to VND 755 trillion, an increase of more than VND 206 trillion compared to 2024. This represents the highest disbursement level in many years and made a significant contribution to full-year GDP growth.

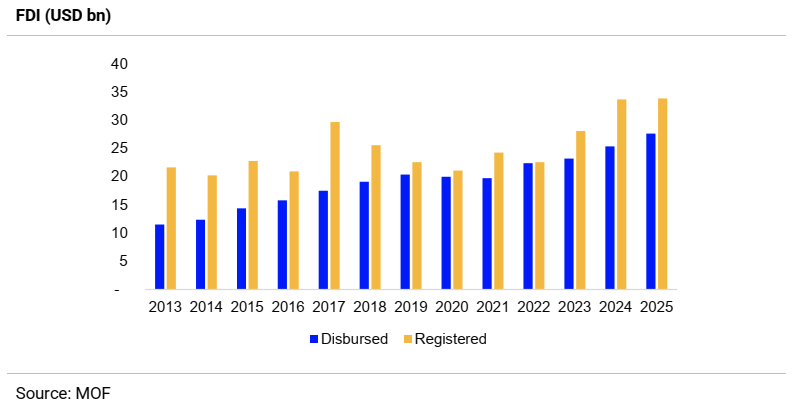

Foreign direct investment (FDI) disbursement also maintained steady growth, reaching USD 27.62 billion, up 9% YoY. However, newly registered FDI moderated, rising by only 0.5% compared to 2024, reflecting a more cautious investment sentiment amid heightened global uncertainties.

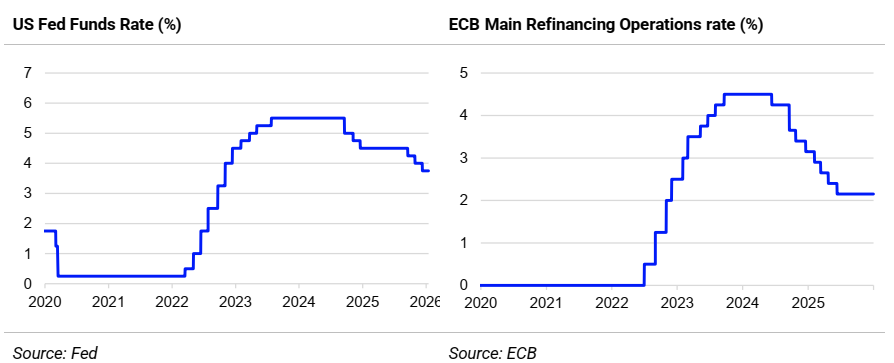

Globally, a slow and uneven economic recovery, prolonged high interest rates in the U.S. and the EU, together with escalating trade and geopolitical tensions, have made international capital flows more selective. Within the region, ASEAN economies have intensified tax incentives and accelerated infrastructure development, creating stronger competitive pressures for Vietnam. Domestically, the Government has tightened environmental and technological standards, requiring FDI projects to meet green growth and digital transformation criteria, while also reviewing tax incentives to align with international commitments. These factors have collectively prompted foreign investors to take a more measured approach to new investment decisions.

Monetary Policy: Cautious Support for Economic Growth

Following significant rate cuts implemented since 2024, interest rates in 2025 were maintained at low levels to continue supporting economic growth. Long-term deposit rates (tenors above 12 months) remained within the 5%–6% per annum range, while short-term rates fluctuated between 3% and 4% per annum.

As a result, money supply (M2), bank deposits, and credit to the economy all recorded robust growth, reaching 14.98%, 14.1%, and 17.87% YoY, respectively—among the highest growth rates in recent years. With credit expanding consistently faster than GDP growth, total outstanding credit reached approximately 143% of GDP in 2025. Such an elevated credit-to-GDP ratio poses structural risks to the economy, including inflationary pressures, heightened liquidity risks, rising non-performing loans, and potential asset bubbles, while also raising concerns over capital allocation efficiency.

Credit growth exceeding deposit mobilization has continued to widen the gap between funding and lending, thereby exerting increasing pressure on system liquidity. By end-2025, total outstanding credit stood at VND 18.4 quadrillion, compared to VND 16.8 quadrillion in total deposits, resulting in a funding gap of nearly VND 1.6 quadrillion.

In addition, around 80% of mobilized funds remain short-term in nature, while nearly 50% of outstanding loans are medium- to long-term. This maturity mismatch, a long-standing structural issue, constrains banks’ balance-sheet management and elevates systemic liquidity risks. Consequently, diversifying financing channels has become an urgent priority to reduce reliance on the banking sector and foster the development of capital markets, particularly long-term funding instruments such as equities and corporate bonds.

Exchange rate stability was one of the key achievements of monetary policy in 2025. The USD/VND exchange rate ended the year with a 3.2% depreciation, despite facing multiple sources of pressure, including: (i) Imports growing faster than exports, and persistent trade deficits among domestic enterprises, weakening net foreign currency inflows; (ii) significant net foreign outflows from the equity market, totaling USD 5.2 billion in 2025; and (iii) heightened foreign currency hoarding, driven by a sharp rise in gold prices and a persistently wide gap between domestic and international gold prices.

It is worth noting that following three Federal Reserve rate cuts in 2025, the U.S. dollar weakened significantly, with the DXY index declining by 9.3% YoY. At the same time, the VND–USD interest rate differential gradually returned to positive territory, enhancing the relative attractiveness of the Vietnamese dong. As a result, exchange rate pressures are expected to ease in 2026, supporting greater currency stability going forward.

Outlook for 2026: Toward a More Comprehensive Development Model

2026 marks the beginning of the 2026–2030 Five-Year Development Plan and is widely regarded as the starting point of Vietnam’s “Era of Aspiration”, during which the country sets out its ambition to advance toward high-income status and strengthen its national standing on the global stage.

The 10% GDP growth target for 2026, while ambitious, has been carefully prepared through a series of landmark reforms initiated in 2025. These reforms center on institutional and administrative restructuring, the promotion of science, technology, and innovation, enhanced international integration, deeper participation in global value chains, and—most critically—the development of the private sector as a central pillar of economic growth.

More importantly, 2025 served as tangible evidence of a marked improvement in policy execution and implementation capacity. This progress underscores Vietnam’s growing ability not only to design ambitious policy frameworks but also to deliver effective outcomes, reinforcing confidence that the country can gradually and sustainably achieve its stated development objectives over the coming decade.

Macroeconomic Stability Amid Heightened Global Uncertainty

In recent years, the global economy has been subject to repeated geopolitical shocks, stemming from major flashpoints such as the Russia–Ukraine conflict, ongoing tensions in the Middle East, and intensifying strategic competition between the United States and China. These developments have had direct and far-reaching impacts on energy prices, financial and monetary markets, global trade flows, and international supply chains.

As these conflicts are unlikely to be resolved in the near term, the global economy is increasingly adapting to a more volatile and uncertain operating environment, characterized by frequent market disruptions and supply chain reconfiguration driven by rising protectionism. While 2026 is expected to see fewer major macroeconomic shocks, microeconomic challenges are becoming a more prominent source of concern.

The rapid adoption of artificial intelligence has delivered a structural shock to labor markets, with job losses emerging across multiple non-technology sectors amid weakening demand and the lingering effects of global trade frictions. A softening labor market, combined with inflation remaining elevated, has constrained consumer spending in many economies worldwide, further weighing on global growth momentum.

In financial markets, following three interest rate cuts in 2025, the U.S. Federal Reserve is expected to implement an additional two rate cuts in 2026. Other major economies, including the European Union and the United Kingdom, began easing monetary policy as early as 2024 and are also expected to continue gradual normalization toward interest rate stabilization, even as inflationary pressures persist. As a result, although the global tightening cycle of 2022–2023 has ended, the pace of easing remains measured, with policy rates likely to stay above historical averages to ensure inflation returns sustainably to target levels.

This environment implies prolonged elevated capital costs, cautious investment flows, and a slower and more uneven global economic recovery.

Given its high degree of trade openness and the fact that domestic consumption has yet to fully recover, Vietnam’s economy remains highly sensitive to external developments. Against this backdrop, diversifying export markets and reducing overreliance on a small number of major trading partners will be critical in enhancing the resilience of Vietnam’s export sector and strengthening its ability to withstand future global shocks.

Building a New Development Model

To achieve its ambitious long-term objectives, Vietnam has made a deliberate shift away from the traditional growth model reliant on capital accumulation, low-cost labor, and natural resources, toward a more inclusive and comprehensive development model anchored in productivity, quality, science and technology, innovation, and digital transformation.

Under this new paradigm, Vietnam places strong emphasis on establishing a flexible and modern institutional framework, transitioning from a control-oriented administrative mindset to a development-oriented governance approach. This transition aims to foster a more enabling environment for the digital economy, green economy, science and technology, as well as strategic sectors such as artificial intelligence and semiconductors.

At the same time, people are positioned at the center of the development process, supported by substantial investment in high-quality human capital, digital skills, and an innovation-driven mindset. In parallel, the economy is being restructured toward modern industrialization, with an emphasis on developing strong economic regions and strengthening linkages among major growth hubs—such as Hanoi–Hai Phong–Quang Ninh and Ho Chi Minh City–Southeast Region–Mekong Delta—to generate spillover effects and improve overall investment efficiency.

The private sector is increasingly recognized as a core pillar of economic growth, while public investment continues to be accelerated to complete critical infrastructure and strengthen the foundations for socio-economic activities nationwide.

Developing Capital Markets to Alleviate Pressure on the Banking System

Against the backdrop of substantial investment needs in the current development phase—across both the public and private sectors—the Government has acknowledged that heavy reliance on bank credit alone is insufficient and could heighten systemic imbalance risks. As a result, developing Vietnam’s capital markets has become increasingly urgent.

Vietnam’s capital market development strategy is focused on building a modern, transparent, and sustainable market, capable of serving as the primary channel for medium- and long-term capital mobilization for the economy. Policy priorities include strengthening the legal and regulatory framework for the equities market, digital assets, and the development of an international financial center, alongside accelerating market-upgrade initiatives to attract greater international capital inflows.

In line with this orientation, the State Bank of Vietnam (SBV) has issued guidance targeting credit growth of around 15% in 2026, with flexibility depending on market conditions. While this target remains relatively high compared to the 10-year historical average, the moderation from the elevated outturn in 2025 reflects the SBV’s cautious policy stance, with an emphasis on containing inflation, preserving macroeconomic stability, and safeguarding the resilience of the banking system, while still providing adequate support for economic growth.

In addition, the SBV has reiterated its focus on tightening credit controls over higher-risk sectors, particularly real estate, while redirecting credit toward productive and priority sectors that are critical to sustaining economic momentum. We expect that this measured and prudent approach will avoid abrupt shocks to the property market, which remains relatively overheated, while continuing to provide meaningful support to key economic sectors in pursuit of Vietnam’s broader growth objectives.

Download the full report

Contact us

Our advisor will contact you as soon as possible

By subscribing you agree to with our Privacy Policy.

Explore more about our solutions

About RatingsRelated Post

Vietnam’s Economy in Q3/2025: Strong Growth Supported by Low Interest Rates Vietnam’s GDP surged 8.23% YoY in Q3, bringing nine-month growth to 7.85%, the second-highest in 15 years, only behind the surge in 2022. Industrials and Construction (+8.69%) led the expansion, with Manufacturing (+9.92%) and Construction (+9.33%) posting robust gains. Services (+8.49%) and Agriculture (+3.83%)

Q1 Production and consumption activities show positive growth GDP growth reached 6.93% YoY in 1Q2025, the highest increase in Q1 since 2020 (Chart 1). This positive result mainly stems from growth momentum in the manufacturing and tourism sectors, with key industries such as manufacturing (+9.3% YoY), hospitality and food services (+9.3% YoY), construction (+8% YoY),

Join our newsletter

Subscribe for the latest updates and news.